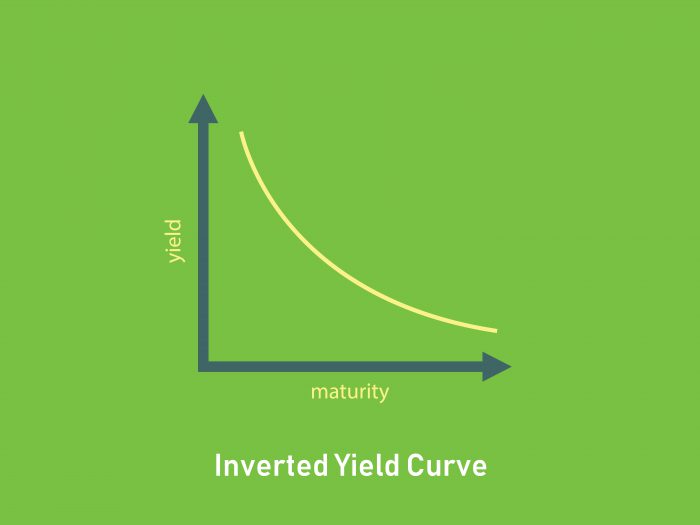

Inverted Yield Curve

Jump to Inverted yield curve - In addition to potentially signaling an economic decline, inverted yield curves also imply that the market believes inflation will.

NEW YORK (AP) — One of the most closely watched predictors of a potential recession just yelped even louder.

The signal lies within the bond market, where investors show how confident they are about the economy by their level of demand for U.S. government bonds.

It's called the 'yield curve,' and a significant part of it flipped Friday for the first time since before the Great Recession: A Treasury bill that matures in three months is yielding 2.45 percent – 0.02 percentage points more than the yield on a Treasury that matures in 10 years.

It seems illogical. Economists call it an 'inverted' yield curve. Normally, short-term debt yields less than a long-term debt that requires investors to tie up their money for a prolonged period. When a short-term debt pays more than a long-term debt, the yield curve has inverted.

And when the yield curve is inverted, it shows that investors are losing confidence in the economy's prospects.

Why is the Dow falling?: Banks and tech stocks drag down market on Wall Street

Papa John's new ambassador: Shaquille O'Neal will be the face of pizza chain

Why you should care

This warning signal has a fairly accurate track record. A rule of thumb is that when the 10-month Treasury yield falls below the three-month yield, a recession may hit in about a year. Such an inversion has preceded each of the last seven recessions, according to the Federal Reserve Bank of Cleveland.

The last time a three-month Treasury yielded less than a 10-year Treasury was in late 2006 and early 2007, before the Great Recession made landfall in December 2007.

Why did the yield curve invert?

Longer-term Treasury yields have been falling this year, in part on worries that economic growth is slowing around the world. When investors become nervous, they often abandon stocks and other risky assets and flock to Treasurys, which are among the world's safest investments. High demand for bonds will, in turn, send yields falling. Accordingly, the yield on the 10-year Treasury has sunk to 2.43 percent from more than 3.20 percent late last year.

Shorter-term rates, by contrast, are influenced less by investors and more by the Federal Reserve, which raised its benchmark short-term rate seven times over the past two years. Those rate hikes had been forcing up the three-month yield, to 2.45 percent from 1.71 percent a year ago. This momentum will likely slow now that the Fed foresees no rate hikes in 2019. But if longer-term Treasury yields continue to weaken, the curve could remain inverted.

Is it a perfect predictor?

No, an inverted yield curve has sent false positives before. The yield curve inverted in late 1966, for example, and a recession didn't hit until the end of 1969.

Haven't we heard this before?

Other parts of the yield curve inverted late last year, as when the five-year Treasury's yield dropped below the three-year yield. Those parts of the yield curve, though, aren't as closely watched.

And not every part of the yield curve is inverted. Many traders on Wall Street also pay close attention to the difference between two-year and 10-year Treasurys. That part of the curve is still not inverted. The 10-year yield of 2.43 percent is still above the two-year yield of 2.32 percent.

Fighters who crave ihstant gratification are out of luck. Kung Fu TheaterKung fu movie fans will get a kick out of Supreme Warrior in more ways than one. A single move can require hitting a button, a directional, and shift button, which subjects first-timers to major finger fumbling. Eventually, the controls respond crisply, but you endure beatings in the process.Add to that the fact that Warrior's designed so opponents are open to hits only at certain instances during a match, and you've got a nasty struggle on your hands. In fact, you'll feel like you're learning a martial art before you master the game's ten basic punches and kicks and three blocks. Supreme warrior.

So is a recession coming or not?

It's too soon to say. Economic growth is slowing around the world, but the U.S. job market remains relatively strong.

'This is a signal that we should take seriously,' said Frances Donald, head of macroeconomic strategy at Manulife Asset Management. 'However, it's too early to tell whether this is indeed a harbinger of a recession or a blip. For me to feel confident to say this is a predictor of recession, I would need to see it persist for at least one to two months.'

Potentially more concerning, Donald said, is how businesses and consumers react to the inverted yield curve. If they were to cut back on hiring or spending, that could trigger a self-fulfilling prophecy that leads to a recession.

'We're so accustomed to this telling us a recession is ahead that my concern is businesses and households get so scared they effectively create one,' she said.